Tax Brackets Alberta . Here are the tax brackets for alberta and canada based on your taxable income. The tax rates in alberta range from 10% to 15% of income and the combined federal and provincial tax rate is between 25% and 48%. The alberta tax brackets and personal. The following forms are commonly used. To build on alberta’s already strong personal tax advantage, alberta’s government intends to introduce a new personal income tax. Estimate your provincial taxes with our free alberta income tax calculator. See your tax bracket, marginal and average tax rates, payroll. 14 rows alberta 2024 and 2023 tax rates & tax brackets. Alberta personal income tax act s. 2023 alberta provincial and federal income tax brackets. Your taxable income is your income after various deductions, credits, and exemptions have been. These rates apply to your taxable income. Alberta's personal income tax system is administered by the canada revenue agency (cra).

from davineymalina.pages.dev

14 rows alberta 2024 and 2023 tax rates & tax brackets. Your taxable income is your income after various deductions, credits, and exemptions have been. Here are the tax brackets for alberta and canada based on your taxable income. The tax rates in alberta range from 10% to 15% of income and the combined federal and provincial tax rate is between 25% and 48%. Alberta personal income tax act s. These rates apply to your taxable income. The alberta tax brackets and personal. Alberta's personal income tax system is administered by the canada revenue agency (cra). The following forms are commonly used. 2023 alberta provincial and federal income tax brackets.

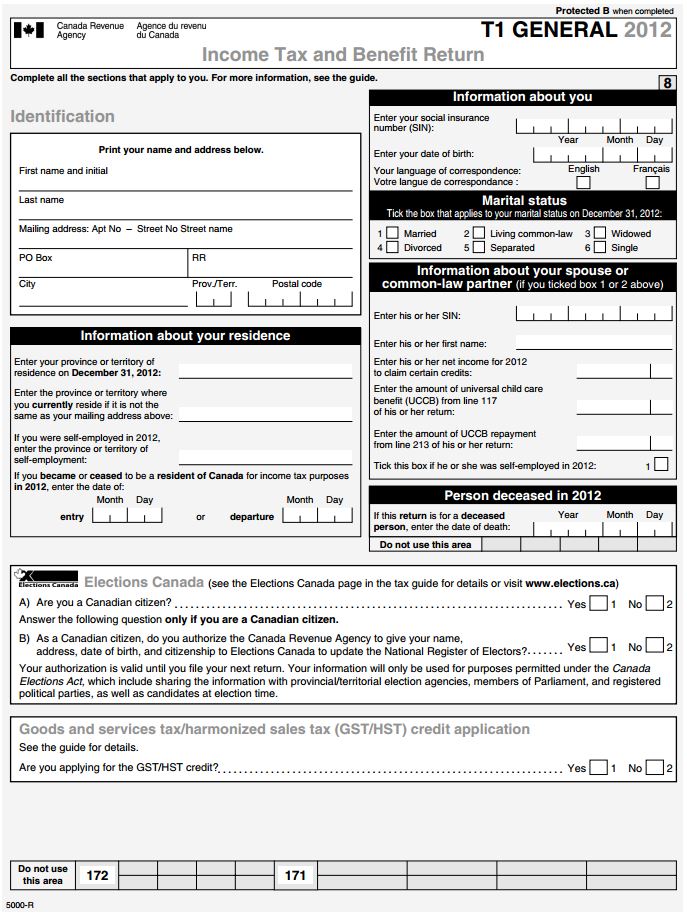

2024 Personal Tax Credits Return Form Alberta Linda Paulita

Tax Brackets Alberta The following forms are commonly used. See your tax bracket, marginal and average tax rates, payroll. The alberta tax brackets and personal. Here are the tax brackets for alberta and canada based on your taxable income. Alberta personal income tax act s. 2023 alberta provincial and federal income tax brackets. Alberta's personal income tax system is administered by the canada revenue agency (cra). To build on alberta’s already strong personal tax advantage, alberta’s government intends to introduce a new personal income tax. 14 rows alberta 2024 and 2023 tax rates & tax brackets. These rates apply to your taxable income. Estimate your provincial taxes with our free alberta income tax calculator. The following forms are commonly used. Your taxable income is your income after various deductions, credits, and exemptions have been. The tax rates in alberta range from 10% to 15% of income and the combined federal and provincial tax rate is between 25% and 48%.

From www.linkedin.com

Understanding 2023 Tax Brackets What You Need To Know Tax Brackets Alberta These rates apply to your taxable income. 2023 alberta provincial and federal income tax brackets. Alberta's personal income tax system is administered by the canada revenue agency (cra). See your tax bracket, marginal and average tax rates, payroll. The following forms are commonly used. To build on alberta’s already strong personal tax advantage, alberta’s government intends to introduce a new. Tax Brackets Alberta.

From guiypierrette.pages.dev

2024 Tax Rates And Brackets Alberta Regan Julina Tax Brackets Alberta To build on alberta’s already strong personal tax advantage, alberta’s government intends to introduce a new personal income tax. The alberta tax brackets and personal. Alberta's personal income tax system is administered by the canada revenue agency (cra). Your taxable income is your income after various deductions, credits, and exemptions have been. These rates apply to your taxable income. The. Tax Brackets Alberta.

From www.youtube.com

Understanding Canadian Tax Brackets and Taxes in Canada (2023 Guide Tax Brackets Alberta See your tax bracket, marginal and average tax rates, payroll. 14 rows alberta 2024 and 2023 tax rates & tax brackets. 2023 alberta provincial and federal income tax brackets. These rates apply to your taxable income. Estimate your provincial taxes with our free alberta income tax calculator. The alberta tax brackets and personal. To build on alberta’s already strong personal. Tax Brackets Alberta.

From evaniableticia.pages.dev

2024 Tax Brackets Mfj Nonah Annabela Tax Brackets Alberta The following forms are commonly used. The tax rates in alberta range from 10% to 15% of income and the combined federal and provincial tax rate is between 25% and 48%. 2023 alberta provincial and federal income tax brackets. To build on alberta’s already strong personal tax advantage, alberta’s government intends to introduce a new personal income tax. Your taxable. Tax Brackets Alberta.

From alaynechryste.pages.dev

Tax Brackets 2024 Head Of Household Chores Tedi Abagael Tax Brackets Alberta Estimate your provincial taxes with our free alberta income tax calculator. 14 rows alberta 2024 and 2023 tax rates & tax brackets. Alberta personal income tax act s. These rates apply to your taxable income. The tax rates in alberta range from 10% to 15% of income and the combined federal and provincial tax rate is between 25% and 48%.. Tax Brackets Alberta.

From angelabmadeleine.pages.dev

2024 Tax Rates And Standard Deduction U/S Nelly Marlane Tax Brackets Alberta Alberta's personal income tax system is administered by the canada revenue agency (cra). These rates apply to your taxable income. The tax rates in alberta range from 10% to 15% of income and the combined federal and provincial tax rate is between 25% and 48%. The alberta tax brackets and personal. To build on alberta’s already strong personal tax advantage,. Tax Brackets Alberta.

From rozebrhiamon.pages.dev

2024 Personal Tax Credits Return Alberta Meade Sibilla Tax Brackets Alberta See your tax bracket, marginal and average tax rates, payroll. Alberta personal income tax act s. Alberta's personal income tax system is administered by the canada revenue agency (cra). These rates apply to your taxable income. 14 rows alberta 2024 and 2023 tax rates & tax brackets. To build on alberta’s already strong personal tax advantage, alberta’s government intends to. Tax Brackets Alberta.

From davineymalina.pages.dev

2024 Personal Tax Credits Return Form Alberta Linda Paulita Tax Brackets Alberta The tax rates in alberta range from 10% to 15% of income and the combined federal and provincial tax rate is between 25% and 48%. Estimate your provincial taxes with our free alberta income tax calculator. The following forms are commonly used. See your tax bracket, marginal and average tax rates, payroll. 2023 alberta provincial and federal income tax brackets.. Tax Brackets Alberta.

From charmanewfay.pages.dev

Tax Brackets 2024 What I Need To Know. Jinny Lurline Tax Brackets Alberta The alberta tax brackets and personal. 14 rows alberta 2024 and 2023 tax rates & tax brackets. Alberta personal income tax act s. Here are the tax brackets for alberta and canada based on your taxable income. To build on alberta’s already strong personal tax advantage, alberta’s government intends to introduce a new personal income tax. 2023 alberta provincial and. Tax Brackets Alberta.

From guinnabantonetta.pages.dev

2024 W2 Irs Janaye Veronique Tax Brackets Alberta 2023 alberta provincial and federal income tax brackets. The alberta tax brackets and personal. 14 rows alberta 2024 and 2023 tax rates & tax brackets. The following forms are commonly used. To build on alberta’s already strong personal tax advantage, alberta’s government intends to introduce a new personal income tax. Your taxable income is your income after various deductions, credits,. Tax Brackets Alberta.

From devinablaverne.pages.dev

Standard Tax Deduction 2024 Married Over 65 Timmi Steffane Tax Brackets Alberta Alberta's personal income tax system is administered by the canada revenue agency (cra). See your tax bracket, marginal and average tax rates, payroll. Here are the tax brackets for alberta and canada based on your taxable income. The tax rates in alberta range from 10% to 15% of income and the combined federal and provincial tax rate is between 25%. Tax Brackets Alberta.

From corieladonna.pages.dev

Tax Rate 2024 Of Legendsourabh Rania Lethia Tax Brackets Alberta Alberta personal income tax act s. The alberta tax brackets and personal. The tax rates in alberta range from 10% to 15% of income and the combined federal and provincial tax rate is between 25% and 48%. Alberta's personal income tax system is administered by the canada revenue agency (cra). 14 rows alberta 2024 and 2023 tax rates & tax. Tax Brackets Alberta.

From fauniebgiacinta.pages.dev

Tax Calculator 2024 South Africa Muire Tiphani Tax Brackets Alberta The tax rates in alberta range from 10% to 15% of income and the combined federal and provincial tax rate is between 25% and 48%. These rates apply to your taxable income. The following forms are commonly used. Estimate your provincial taxes with our free alberta income tax calculator. Alberta's personal income tax system is administered by the canada revenue. Tax Brackets Alberta.

From evaniableticia.pages.dev

Single Tax Rates 2024 Malta Nonah Annabela Tax Brackets Alberta Alberta personal income tax act s. Estimate your provincial taxes with our free alberta income tax calculator. 14 rows alberta 2024 and 2023 tax rates & tax brackets. The following forms are commonly used. These rates apply to your taxable income. See your tax bracket, marginal and average tax rates, payroll. To build on alberta’s already strong personal tax advantage,. Tax Brackets Alberta.

From guiypierrette.pages.dev

2024 Tax Rates And Brackets Alberta Regan Julina Tax Brackets Alberta Alberta personal income tax act s. Alberta's personal income tax system is administered by the canada revenue agency (cra). Estimate your provincial taxes with our free alberta income tax calculator. Your taxable income is your income after various deductions, credits, and exemptions have been. To build on alberta’s already strong personal tax advantage, alberta’s government intends to introduce a new. Tax Brackets Alberta.

From rozebrhiamon.pages.dev

2024 Personal Tax Credits Return Alberta Meade Sibilla Tax Brackets Alberta The following forms are commonly used. Here are the tax brackets for alberta and canada based on your taxable income. Alberta personal income tax act s. To build on alberta’s already strong personal tax advantage, alberta’s government intends to introduce a new personal income tax. These rates apply to your taxable income. The tax rates in alberta range from 10%. Tax Brackets Alberta.

From www.savvynewcanadians.com

Alberta Tax Rates and Tax Brackets in 2024 Tax Brackets Alberta Estimate your provincial taxes with our free alberta income tax calculator. The alberta tax brackets and personal. Your taxable income is your income after various deductions, credits, and exemptions have been. Alberta personal income tax act s. 14 rows alberta 2024 and 2023 tax rates & tax brackets. The tax rates in alberta range from 10% to 15% of income. Tax Brackets Alberta.

From kalietimmie.pages.dev

2024 Personal Tax Credits Return Alberta Joy Wileen Tax Brackets Alberta The alberta tax brackets and personal. Alberta personal income tax act s. Here are the tax brackets for alberta and canada based on your taxable income. The tax rates in alberta range from 10% to 15% of income and the combined federal and provincial tax rate is between 25% and 48%. Alberta's personal income tax system is administered by the. Tax Brackets Alberta.